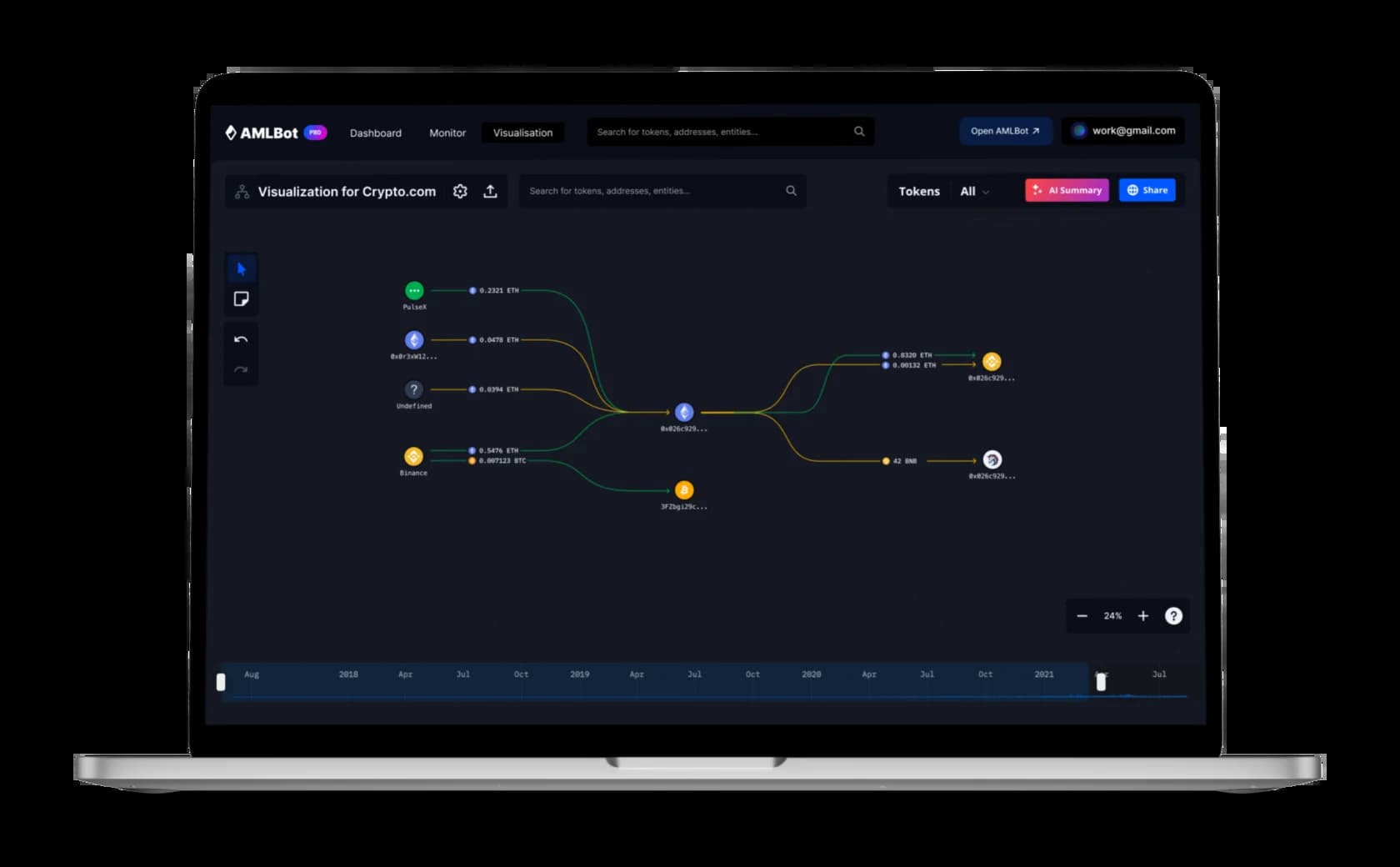

One-stop compliance solution for crypto business

The AMLBot platform automates AML / KYC procedures and reduces compliance expenses

The AMLBot platform automates AML / KYC procedures and reduces compliance expenses

INATBA

INATBA CDA

CDA ATII

ATII LSW3

LSW3 ЕВА

ЕВАAmount of the risky funds detected

Compliance departments that accept our AML procedures

Service providers checked

We provide full pack of options for safe work with crypto

API solutions that empower AML compliance tools within your current system. All transactions are automatically verified to comply with AML and FATF requirements and reduce your business risk exposure.

The streamlined and automated verification process empowers your business to swiftly onboard customers, reducing manual effort and mitigating identity fraud and illicit activity risks.

Launch your crypto venture with ease, simplicity, and confidence through our streamlined AML and KYC consulting, ensuring smooth compliance and effective risk management right from the beginning.

Streamline corporate account opening on CEX EMI with our expert assistance, ensuring your focus remains on business growth in the crypto industry.

Recover stolen cryptocurrencies with AMLBot's expert blockchain investigations, swiftly identifying culprits and tracing funds for effective recovery.

AMLBot understands the significance of fast, friendly customer support, thus we're always here for our clients. 24/7 support.

An answer during the night may take a bit longer

Contact us via messenger. We are in touch 24/7, so any issue can be resolved quickly and in a live chat format.

It may take a little longer to respond during the night.